- About Us

Who we are ... Ceramica Orient

It is not a mere coincidence that “Ceramica Orient” entered the field of ceramics and porcelain manufacturing.

This decision was based on extensive studies, relying on decades of commercial experience, hard work, and effort in the sanitary-ware market in general, and the ceramics trade in particular.

Through a vast network of traders, distributors, and a chain of exhibitions throughout Egypt, we have had the opportunity to understand the market’s needs and the tastes and desires of our prospects and consumers.

While some other companies started with ceramics production and then switched on other activities to meet market needs and satisfying consumer desires, Ceramica Orient, with its long commercial experience and knowledge of consumer preferences, established its position from the ground up by producing what the market requires and entering the world of ceramics industry armed with commercial expertise. Despite its relatively new presence in this industry, it managed to position itself among the ceramic and porcelain manufacturers, earning a prestigious and distinctive place on the business map of this industry.

Télécharger Catalogues De Produits

What We Do

Our Main Categories

ORIENT CERAMICS

A success story from trade to industry.

Our long experience lies primarily in the field of ceramics, porcelain, and sanitaryware trade.

This experience has helped us understand the market needs and cater to various tastes by providing the latest designs suitable for these needs, ensuring maximum comfort and attractiveness for the consumers. We prioritize high quality to achieve complete customer satisfaction.Our vision started with the aim of positioning Ceramica Orient among the leading ceramic and porcelain manufacturing companies in Egypt in a short period of time.

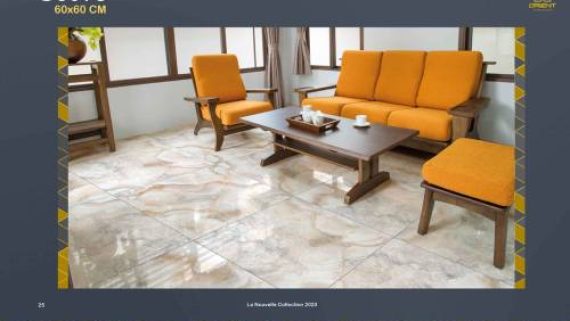

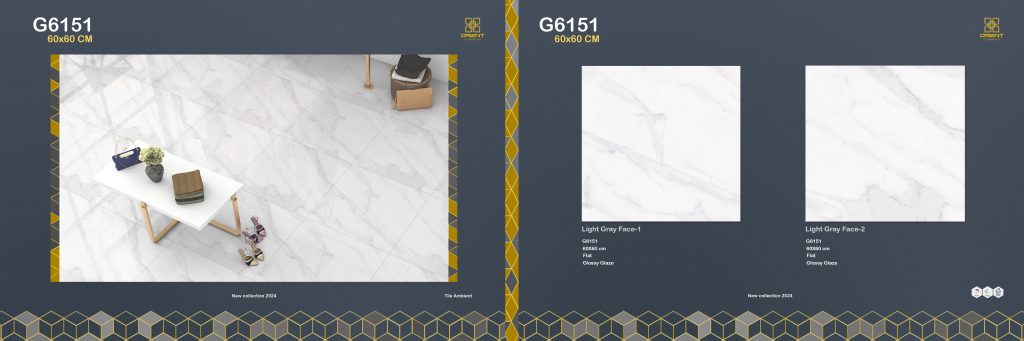

This would be achieved by offering high-quality products made from the finest imported materials, setting our products apart from others. We strive to provide the best and latest designs at reasonable prices that cater to all levels of customers.

- ABOUT US

How We Operate

Over the years, we have successfully conducted countless projects with Fortune 500’s not only but also brand-new startups.

We help ambitious businesses like yours generate more profits by building products awareness, satisfying customers needs, and growing overall sales.

VERIFIABLE RESULTS

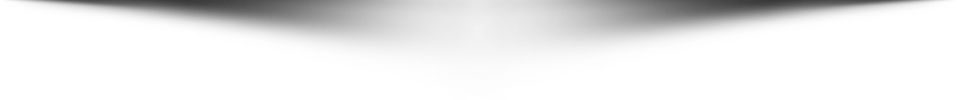

A life you Deserve ... Variety of Colors & Choices

Consulting

whether you are decorating your new house or renewing the existing one, our highly experienced consultants can help you achieve the best in respect to your house dimensions and taste

CUSTOMER SUPPORT

We believe success is not a coincidence but a decade of experience to better understand and support our customers needs

Availability

Our show rooms and partners, are widely distributed among the country to better serve you on the right time and the right place

VERIFIABLE RESULTS

A life you Deserve ... Variety of Colors & Choices

Consulting

whether you are decorating your new house or renewing the existing one, our highly experienced consultants can help you achieve the best in respect to your house dimensions and taste

CUSTOMER SUPPORT

We believe success is not a coincidence but a decade of experience to better understand and support our customers needs

Availability

Our show rooms and partners, are widely distributed among the country to better serve you on the right time and the right place